How does mortgage broking work?

How does mortgage broking work?

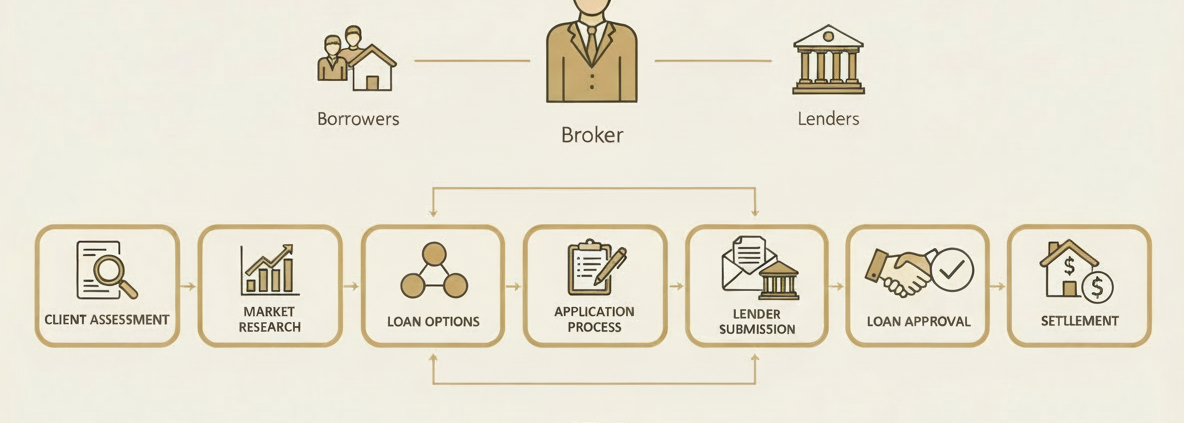

Mortgage broking involves acting as an intermediary between borrowers and lenders to find and secure mortgage deals. Here’s a simplified overview:

- Client Assessment: The broker assesses the client’s financial situation, goals, and borrowing needs.

- Market Research: The broker researches and compares various loan options from multiple lenders.

- Loan Options: The broker presents the client with suitable loan options, highlighting features, benefits, and costs.

- Application Process: The broker assists the client with the loan application, ensuring all necessary documentation is provided.

- Lender Submission: The broker submits the application to the chosen lender.

- Loan Approval: The lender assesses the application and approves or declines the loan.

- Settlement: If approved, the broker facilitates the loan settlement process.

Mortgage brokers should have access to a range of lenders and loan products, allowing them to shop around for the best deals for their clients. They can also help with paperwork, negotiations, and ensuring the loan meets the client’s needs.

In Australia, mortgage brokers are required to hold a credit license or work under someone who does. They must also adhere to responsible lending practices and provide clients with a Credit Guide and a Key Fact Sheet outlining the loan details.